Diagrams of Cybernetic Circulation

To accompany their recent book, Nick Dyer-Witheford and Alessandra Mularoni share a diagram of the cybernetic circulation of commodities

Our book Cybernetic Circulation Complex: Big Tech and Planetary Crisis examines the U.S. tech sector through the Marxist concept of “circulation.” We focus on the major U.S. tech oligopolies—the original “Big Five” (Google/Alphabet, Apple, Amazon, Facebook/Meta, and Microsoft), now joined by Nvidia and Tesla (with Musk’s X and SpaceX) in the so-called “Magnificent Seven.”

Much of their activity, we argue, is less about production than about circulation—sales, marketing, advertising, and financialization. If Big Tech produces anything, it is circulation itself.

We extend this analysis through Marxist traditions that examine how Big Tech circulates social antagonisms, disrupts ecological cycles, inaugurates new AI-driven circulations, and opens the possibility of revolutionary biocommunist circulations for equality and sustainability.

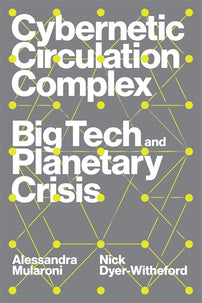

And because a picture is worth a thousand words, with graphic designer Giles Whitaker we’ve created a series of slides to illustrate the book. Here, as an example, is Slide 7: The Cybernetic Circulation of Commodities.

The Cybernetic Circulation of Commodities

This diagram builds on Marx’s model of the circuit of capital. For Marx, surplus value is created in production (P). But only if commodities (C) circulate through markets and return as money (M′) can capital become a self-generating growth process. Speeding circulation can have the same effect as expanding production itself.

We add two modifications. First, Marx’s “money-dealing” (M-M′)—capital’s attempt to bypass production and make money from money—has, in the age of financialization, grown into a vast machinery of debt, credit, stocks, derivatives, and speculation. Second, as feminist Marxists stress, consuming commodities in everyday life requires constant effort: social reproduction is part of the circuit.

As the circuit expands, so do its sites—warehousing, logistics, marketing, advertising, payments, speculation. The acceleration of circulation—what Marx called the “annihilation of space by time”—rules the world market.

Big Tech is the latest iteration of this circulatory acceleration. Cybernetics is automation—and what firms like Alphabet, Apple, Amazon, Meta, and Microsoft automate is not primarily production, but circulation. Think bots rather than robots, or robots laboring in warehouses and logistics hubs rather than factories. These companies together form what we call the Cybernetic Circulation Complex (CCC).

[book-strip index="1"]

Reading the Diagram

Look to the **right** side of the diagram, where commodities (C) become money (M). Google and Meta present themselves as platforms for search or social media, but their core business is advertising—what Tim Hwang calls “the dark beating heart of the internet”, the motor of surveillance capitalism.

From ads we move to sales. Amazon warehouses may resemble factories, but as Charmaine Chua observes, they “produce nothing but deliver everything.”

As the CCC accelerates circulation, it also reshapes social reproduction. Even hardware like smart home devices—sold by Google and Amazon—are Trojan horses for surveillance and advertising. Smartphones, programmed by Apple and Google, automate daily life, altering circadian rhythms, intimacy, parenting, children’s media use, and youth socialization.

On the left of the diagram, where profits are reinvested to buy more means of production (M-C), the CCC has transformed labor. The gig economy—Mechanical Turk, Uber, food delivery—atomizes work into precarious, on-call fragments, creating what economist Gil Felix calls a “super-circulation” of labor power. Influencers, dropshippers, and multi-level marketers become self-employed ad workers, aided by mid-tier CCC firms like Salesforce, Shopify, and PayPal.

Look further left for financialization in overdrive. Venture capital was born in Silicon Valley; Big Tech became “big” by promising outsized stock returns. Asset managers like BlackRock and Vanguard, handling billions for pension funds and the ultra-rich, now sit on Big Tech boards. Meanwhile, Big Tech props up Wall Street by supplying cloud infrastructures and fintech services—while also speculating in the markets themselves. Apple runs its own hedge fund; others edge toward becoming banks through credit and payment systems.

Do we overstate Big Tech’s circulatory role? After all, Apple manufactures devices (via Foxconn), Microsoft develops software, Amazon and Google build data centers. But even these are circulation machines. The smartphone is a shopping device; the data center manages transactions and logistics. Like railways in Marx’s era, Big Tech turns circulation itself into a branch of production.

[book-strip index="2"]

Into the Vortex

Our book develops the social, ecological, and political consequences of the process shown in this single slide. But here’s a closing note: it is in this vortex of circulation that the AI boom emerged.

Generative AI systems—ChatGPT, Midjourney, Claude—feed on Big Tech’s big data. The people responsible for their development, like Sam Altman, cut their teeth in online payments and social media. Even before ChatGPT, firms like Google and Uber used AIs to run search, ride-hailing, and social platforms. Today, scaled up and fine-tuned, these systems are sold as commodities and hyped as speculative assets.

New AI firms (OpenAI, Anthropic, Midjourney) compete with Big Tech even as they are bankrolled by it. The result is a strange loop: AI is circulation technology, now sold as a commodity, and reinvested back into production. The fate of a vast speculative bubble rests on this recursive process.

The full deck of twelve slides illustrating Cybernetic Circulation Complex: Big Tech and Planetary Crisis can be viewed and downloaded at [Platforms, Populisms, Pandemics and Riots](https://projectpppr.org/). Our thanks to the Social Sciences and Humanities Research Council of Canada for funding.