Follow the Money

Will the current geopolitical crisis generate new directions for wealth and inequality in cities like London? Rowland Atkinson, author of Alpha City, on Russian money in London.

The world is watching as events are escalating between Russia and Ukraine. Meanwhile, the leaders of the West threaten sanctions against Putin’s associates. But where does this leave cities like London, Paris and New York which have for a long time courted the wealth of oligarchs? An alpha city like London, at the top of the global league of sites to trade, live and invest among the super-rich has long offered an open door, with light touch regulations that asked few questions of its wealthy new arrivals. There is a reason that so many of Putin’s coterie of compliant oligarchs have chosen to call Londongrad home, since the fall of the Soviet Union. These choices go beyond a strange penchant for warm beer or rainy weather. London delivers access, few questions and good investments and fine property to spend time in.

What is the impact of this movement on the city, and the country at large? There are big differences between a national group finding a home in a cosmopolitan city, and the channelling of billions of illicit or politically-connected wealth into property and other assets. It has been calculated that the Russian community has donated over £2 million to the Conservative Party. So, amidst concerns about Russophobia and political corruption, we need to keep our eyes firmly on the ball - follow the money, first and foremost. Secondly, trace the arc of the long story, not the daily newsfeed.

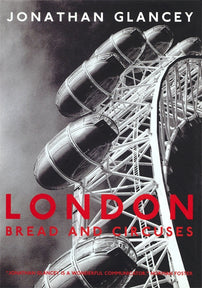

[book-strip index="1" style="buy"]In the febrile world of commentary and news we see it is Russian oligarchs, then multi-millionaires from France, the Middle East or East Asia reportedly buying up ‘swathes’ of London. But the real story here is not one of nationality, but of money. Lots of it. What are the consequences of this?

First, big money damages the city for all, as I tried to explain in detail in Alpha City, raising property prices, skewing political agendas towards serving the wealthy and displacing those on moderate or low incomes through land grabs and diminished welfare provisions.

Second, what we might call catastrophic money is on the front page of every global news outlet, focused like a laser on the operation of the London property market. It is impossible to avoid the question of money laundering by wealthy Russians and others, and its cementing of the place of hostile foreign government compatriots in domestic politics. The city is, in both ways, a critical conduit of social relations and cash, and both are damaging urban life and our political system.

There has been a sudden interest in the scale of this wealth and its pouring like cement into elite prime property. Some of these stories should raise eyebrows and perhaps tempers, with coverage of the many billions laundered through UK and London property, or that snapped-up by the young children of oligarchs.

However, in addition, London’s wealth is today wrapped up not only in the question of local inequalities but also geopolitical tensions. Writing today, Russia stands on the brink of regional conflict, with serious questions being asked about the kind of economic actions that the Western powers might use to challenge those actions. However, it seems increasingly clear that the UK government is closely linked, by donations and personal connections, to the emissaries of that state. Meanwhile, any effort to tackle laundering comes long after many billions have already purchased hundreds of fine properties.

Growing over the last two decades has been this huge story of the way that London has enabled money laundering and development to be tailored and expanded to the needs of the world’s rich. The various financial leaks show this, as do numerous reports from NGOs. This reporting has generated another potential time bomb under the Johnson administration as questions are asked about why the use of better measures, reforms to investor passports and the City’s complicity in facilitating Russian and other politically ‘exposed’ wealth to infiltrate the city’s markets have not been pursued. The current debacle has drawn attention to the question of big money and its sources and what many now see as the planned inaction of government on the issue of illicit wealth.

[book-strip index="2" style="display"]London property has been used to store, and wash, criminal capital, and to provide bases for members of the politically-connected elite of other countries. Right now, for example, around 75% of its national wealth lies outside Russian national boundaries. But it is the money of its most powerful and rich, those connected to Putin himself that is of most concern. Such money flows to British universities (including Oxford), to pay for connections to the Conservative party and is used to wash the reputations of the rich through acts of philanthropy.

In recent frenzied weeks the Ukraine crisis has provoked sudden reform. The wholesale scrapping of the ‘golden visa’ scheme was first. Unbelievably, this legal mechanism that allowed the rich to jump the queue on residency, had peaked in recent years – with 798 investor visas granted in the year to September 2021, 82 of which were awarded to Russians. This was the highest annual total since 2018.

Next was promised action on laundering, by enabling the beneficial owners of property and assets to be identified in new legislation. Delays over years gave way to the signal of rapid action. Dismay followed. In fact, neither of these actions would matter to the extent that they will only tackle future flows of bad money - right now they do nothing to eject the influence of advisers and friends from government circles, unhouse owners of mega-mansions or rid corporate vehicles and companies of illicit investors. For example, in one recent figure it was estimated that Russians accused of corruption or direct links to the Kremlin had bought around £1.5bn of property in London while a further 2,189 companies are registered UK and its offshore dependencies that have been used in 48 Russian money laundering cases.

Even tentative steps are taken too late. We already know from Britain’s own National Crime Agency estimates that around £100bn is laundered annually through the UK, via London in particular. We also know that a vast amount of property across the UK is held by offshore companies, foreign nationals and super-rich ‘non-dom’ registered individuals. All of this highlights how London as an alpha city is not simply a place where the rich come to live amidst some vibrant tapestry of social life, but a place contaminated and degraded by big money. The city has become somewhere for the rich to be actively maintained, their criminality glossed-over and their influence as agents of hostile or human-rights denying powers concealed.

One cannot mistake the irony, however. The fact of Russian money in London property has allowed the UK government to present itself as some kind of saviour, rushing to assist NATO by facing-down the threat of Putin via (so far) incredibly mild sanctions on a tiny number of his associates. With money in bricks and mortar and other investments in the UK we may have some kind of leverage, but it certainly isn’t being used yet.

But these actions only raise more questions. Why has this government enabled such purchases for such a long time despite the flagging of thousands of dodgy deals by lawyers, estate agents and NGOs? Even the tools designed for the job are left in the toolbox. In 2017 the Criminal Finances Act created the Unexplained Wealth Order to challenge laundering by allowing difficult questions to be asked of suspects and politically exposed individuals. Red faces all round then that, to June 2021, a grand total of four (yes, 4) of these have been pursued, with all the impact of a marble in a storm drain.

What these issues do highlight is how cities are critical to the story of contemporary wealth, inequality and political corruption. London appears to be hardwired to enable criminality when it suits the purses of those in charge. The city, comprising legal firms, corporations, financial advisers, its political machine and its planning operations have in many ways been captured by the wealth and power of the rich. The nervous energy generated by Russia today simply adds a new battery to the torch throwing a bright light on these murky operations.

In many ways this story continued because no one appeared to be directly hurt by making an extra buck or two. The harms of laundering the abundance of wealth in London are in many ways subtle problems for a city to bear. But they are experienced in rising house prices, escalating fees for anyone in on the action. Turning off this great faucet of cash is privately seen as being in no one’s interests, particularly the developers, estate agents, decorators, legal firms, and companies connected at some level when the good times rolled. There is little or no consideration for the impact of criminality on the growing social divisions and inequalities exacerbated by the on-going graft.

Russian money has been followed by the UK parliament for some time. Questions over Russian money in funding the Vote Leave campaign alongside stories of empty flats and laundering through property provoked the attention of the Foreign Affairs Committee in 2019. Its report “Moscow’s Gold” showed that huge amounts had been secreted in property as part of a concerted effort to locate compliant oligarchs and super-wealthy Putin sympathisers in London connected to the extended social networks of officials. Distracted perhaps by Brexit deliberations over the report gained little traction despite its dynamite conclusions.

Nonetheless the city’s money machine, its raw material input of capital, processed by wealthy individuals, legal systems and supply of properties is becoming increasingly transparent. This week another report exploded in the form of the Credit Suisse leaks, hard on the heels of others, highlighting how elite and illicit life are less and less able to exclude scrutiny. Investigative journalists, parliamentary committees, the work of non-government organisations examining questions of tax and fairness are increasingly showing the scale of the money involved, who is implicated and what can be done. Social media has accelerated the flows of this data and the conversations surrounding what is to be done.

Alpha City was part of a project seeking to aid public understanding of how the city as money machine worked, but also to consider its wider effects. While the Sauron’s eye of the media focuses on the question of Russian money, the everyday life of the city resides in discussions about housing, policing, education and health challenges. In a city pre-eminent in the league of billionaires and ultra-wealthy individuals it remains hostile to those needing basic forms of social support. Its inequalities and desperation, born of long-term austerity and further exacerbated by the pandemic, have become increasingly hard to avoid. Street homelessness remains evident, as does record levels of food bank use, rocketing rents and scarcity of good housing for families. Seen from ground level Westminster politics appears wholly disconnected from and ignorant of everyday needs.

One of the key arguments contained in Alpha City was to suggest that such a politics is substantially the result of the pursuit of the urban rich, the creation of cosseting, enclosing environments and the disconnection of political reality from social need. Whatever crisis rolls into town these social needs remain unaddressed or callously ignored. Will the current geopolitical crisis generate new directions for wealth and inequality in cities like London?

[book-strip index="3" style="display"]